Berkeley Shaw Real Estate, the Merseyside based Residential agent has grown its portfolio by adding PR Lettings into it’s group structure.

Based in Preston City Centre, PR Lettings was established in 2011 by Mr Harrington who explains, “Initially we started out in our Lancashire heartland of Preston, Burnley and Blackburn nearly 15 years ago, but we have increasingly built relationships with clients in Merseyside who have properties located in Southport, Formby, Crosby and even Liverpool City Centre so we have been looking for a way to take our standards of service to the next level in all areas, and with Berkeley Shaw Real Estate’s offices situated along the North West Coastline, this seemed a great fit for our clients and our staff.”

He adds, “we know that by joining Berkeley Shaw Real Estate it allows PR Lettings & Management staff to benefit not just from additional resources and accreditations, but we can leverage their CRM software, and our Landlords can have real time account information at their finger tips 24/7.”

PR Lettings will rebrand as Berkeley Shaw Real Estate with Jade Wilson and Kyle Hastings continuing to run the area with the support of Berkeley Shaw Directors John Baybut (Chartered Surveyor) and Daniel Morton (Chartered Accountant).

“We are excited to have the support of the Berkeley Shaw Real Estate team in streamlining our finance and management operations, meaning we will become much more accessible for not just our tenants, but our contractors and landlords” said Hastings.

With this exciting development, Kyle and Jade will have more time to undertake inspections and rent reviews, meaning that landlords will be able to increase their investment yields in a compliant and hassle free manner.

Berkeley Shaw Real Estate Managing Director, John Baybut, welcomed his new colleagues; ” PR Lettings & Management have grown an excellent business focused on compliance and relationships, but it’s clear they have outgrown their systems. Our discussions centred around some additional support and guidance in not just growing around Lancashire, but also using our App Based technologies to increase the accuracy of Mid-Term Inspections, Rental Statements and falling in with our Rent Review processes ensuring their Landlord clients’ interests are maximised.”

The team will also have more access to Compliance and Professional Development Training and support services on the behalf of our clients.

Maghull based Ian Crane IDC Estate Agents is the latest estate agent to join Berkeley Shaw Real Estate.

The sales and lettings agent based in Maghull, Liverpool, sees Directors Ian Crane and Mark Evans continue to oversee the commercial property Management and Surveying Relationships while working closely with current Berkeley Shaw Managing Director John Baybut to continue growing their existing market share in Maghull and Southport.

Ian Crane explains, “Berkeley Shaw has been growing their sales and management business in a proper manner recently, and when an opportunity came up for Mark and I to assist with that growth we were keen to explore it.”

Crane continues, “The origins of Berkeley Shaw is right here in Sefton and they have invested in excellent technology and marketing systems that we feel will really help our Sales and Lettings clients whilst also ensuring our current experienced team are still in place to support the re-branding which will be coming soon.”

Following the acquisition of PR lettings in Preston in April, Berkeley Shaw Group has been growing its book of business with managing Director John Baybut observing; “Ian and Mark have led an excellent estate agency for the best part of 2 decades, and we are proud to join forces with them. The firm suits our growth model perfectly as it joins immense local experience with outside marketing investment and brings their customers round-the-clock support via our mobile app-based CRMs.”

The deal represents Berkeley Shaw’s 6th acquisition in recent years as they solidify themselves as leading players in sales, lettings, and management agents in the Liverpool City Region.

For those looking for Ian Crane you can still contact us on those same phone numbers (0151 527 2700), emails and in person at our offices in Maghull Square.

Their team performed outstandingly throughout the extensive judging

period, which focused on customer service levels.

Berkeley Shaw Real Estate Limited have now been shortlisted for a

number of national awards which will be announced shortly.

The British Property Awards provide agents throughout the UK with an

invaluable opportunity to compare the service that they provide against

the service provided by their local, regional and national competition.

Agents who go that extra mile and provide outstanding levels of

customer service are rewarded with our accolade, which acts as a

beacon to highlight these attributes to their local marketplace

The highest number of Letting Instructions.

The highest amount of Available Stock.

The highest number of Agreed Lets

If you would like an award-winning estate agent to sell or

let your property, please get in touch with us on 0151 924 6000.

BUILD Magazine proudly announces Berkeley Shaw Real Estate as the winner of the Real Estate Agency Liverpool 2023.

The BUILD Awards are dedicated to identifying and honouring the very best in technical innovation and services from all around

the world in the construction and property sectors. These awards recognise the key players driving this dynamic industry.

If you would like an award-winning estate agent to sell or

let your property, please contact us on 0151 924 6000.

Despite a decline in transaction numbers in April, rising transaction and mortgage approval numbers in March indicated that the market had shaken off the travails of the autumn and the fallout from the mini-Budget, with house prices continuing to soften slightly and settle into a ‘new normal’. Mortgage pricing also calmed, with borrowers accepting that rates are going to be higher than has been typical over the past few years. However, it would appear that volatility in the housing market is not fully behind us, with the latest news on inflation sending Swap rates higher and increasing the price of fixed-rate mortgages once again.

That said, buyer and seller sentiment was not rocked during May. Our data for May shows 73% of UK buyers were confident that they’d purchase a property within the next three months, compared to 70% in April. Regional differences demonstrate positivity even more starkly, with 75% of London buyers confident they’d purchase a property within the next three months, up from 71% in April. Seller confidence also improved slightly, with 65% of sellers in the UK confident they’d sell their property within the next three months in May, compared with 64% in April. Some areas demonstrated even more positivity, with 72% of Scottish sellers confident they’d sell within the next three months, up from 66% in April. 42% of properties were SSTC within 30 days of first being listed for sale in May, fairly consistent with April’s 43%, while 6% of buyers in need of a mortgage were either very worried or slightly concerned about mortgage availability in May compared with 7% in April.

It’s no real surprise that buyer confidence is strong given that prices are softening in some areas. There’s more choice of stock than has been the case for a while and if you can afford to buy, now is a great time to make a move. Although some buyers will inevitably be worried about higher mortgage rates, there seems to be a growing realisation of the need to adapt to a new, elevated level of pricing, in place of the unsustainable rockbottom rates of the past.

We wait to see how recent volatility pans out but what it does provide is a sense check. There are people who need or want to move, but buyers also believe prices are inflated. With offers regularly being made below asking price, pricing correctly in the first instance is crucial. Sellers and their agents should be having conversations, not just about pricing but about timing. If you want to move by a certain date, ask your agent about various pricing structures and how being sensitive on price can speed up the time it takes to find a buyer. When the market is in flux, pricing competitively means pricing ultra-realistically. The fallout from the latest inflation figures may be felt more keenly in June’s data, with the impact of higher mortgage rates and potential for further base rate rises unsettling buyers and sellers alike. It looks as though the next three months might well be tougher than originally thought and there may be a negative knock-on impact on transaction levels. However, there is no reason why sellers who take advice from an experienced local agent, and price realistically under their guidance cannot still achieve a timely sale.

https://www.onthemarket.com/content/rate-volatility-evident-but-buyer-and-seller-sentiment-remains-strong/

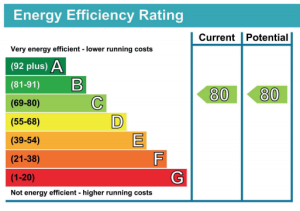

Energy Performance Certificates (EPCs) gives a property its energy performance rating. The energy efficiency of a property is measured on a sliding scale depending on how energy efficient it is. Ratings are from A-G with A being the most efficient and G being the least.

As a landlord, it is a legal requirement to have an up-to-date EPC. Legislation which has been implemented means that a property has to meet Minimum Energy Efficiency Standards (MEES) of an E rating or above in order to comply with regulations.

How long are they valid for?

Energy Performance Certificates are valid for 10 years. If you’ve spent time working on your home and it improves the energy efficiency, you may want to consider having another EPC survey completed to understand how the improvements have increased the efficiency on the property.

What happens during an EPC?

During an EPC, the assessor will look at a range of metrics in order to determine how efficient the property is. All of these components come together to determine the final Energy Performance Certificate. The areas that assessors look at include: the age, construction and size of the property. Primary heating systems including the boiler and heating controls. Insulation, whether there is cavity and loft insulation installed. If there are any secondary heat sources including renewable energy. Lighting, whether any energy saving light bulbs or low energy light bulbs are in use.

How can an EPC be improved?

With significant increases in energy prices and a rising concern on both the part of buyers and tenants when it comes to energy efficiency, taking steps to improve energy efficiency can result in many benefits.

There are a number of considerations to bear in mind when taking steps to improve the energy efficiency of a property. Period homes and older properties can be harder and more expensive to raise the EPC rating. Whereas newer properties may already have some energy efficient features and it is often easier to add more.

The following features have the potential to improve the EPC rating:

• Loft insulation

• Wall insulation

• Double or Triple glazing

• An energy efficient boiler

• Using a renewable energy source such as solar panels or ground source heat pumps

• Ensure all lighting is as efficient as possible

• Install a smart meter and thermostat

• Insulate hot water cylinder

• A seal draughty doors

Legal requirements of an EPC and potential changes to legislation in the pipeline

The latest Minimum Energy Efficiency Standards have been in play since 2020, they will apply to all existing tenancies, not just new ones or renewals. Currently, the fine which can be incurred for not having a valid EPC is £5,000.

However, after a consultation which took place in December 2020, the government announced new standards to become law by 2025. From this date, all rental properties will need an EPC rating of C or above. These new regulations will apply to new tenancies first, followed by all tenancies from 2028.

Berkeley Shaw wins major gong at YM Liverpool Property and Business Awards 2022

Leading Merseyside property agency, Berkeley Shaw, has been named Property Agency of the Year following a record year for the lettings and block management departments.

Berkeley Shaw has been an indomitable agency in the property industry for over 40 years.

Recently, the Berkeley Shaw Group has expanded its block management operations. Having acquired Keppie Massie Residential last year, the group now manages over £1 billion in residential and commercial assets.

Managing Director John Baybut, “We are delighted to have been recognised as Property Agency of the Year at this year’s YM Liverpool Property and Business Awards.

The award is a testament to the hard work delivered by our staff this year. It has been a fantastic year for us as a business. Here’s to a fantastic 2023!”

Saving for a house deposit can be a challenging endeavour. With the onset of rising property prices and a more competitive marketplace, first-time buyers are finding it increasingly difficult to secure the funds required for a deposit. Berkeley Shaw have devised some simple ways to help first time buyers implement a strategy to save enough for a deposit on their first home.

Open a savings account

Open a savings account which is solely for the purpose of saving for your house deposit. This can help you keep your specific savings separate from your everyday spending account and other savings accounts which are designated for other purposes. The best type of savings accounts for this purpose can depend on a variety of factors including the level of savings that’s required, the regularity of adding to your savings and length of time the savings need to be completed by.

Managing your outgoings

It is expensive living in the modern world. Particularly if you subscribe to various services such as Netflix, Spotify, gym memberships along with an eating out lifestyle and indulging in artisan coffees can, over the course of a year, rack up to potentially significant figures. For those serious enough about saving for a deposit, an accurate evaluation of an individual’s outgoings and cutting back on those which are superfluous may speed the process up saving dramatically.

Set out a budget and stick to it

The process of budgeting will be a useful reflection tool to help first time buyers reflect on their current financial position. Firstly, it is important to accurately understand the finances coming in each month and understand overall outgoings.

In order to do this you’ll need to gather all of your financial information together including: regular household bills, living costs, insurance policies, travel expenses, leisure costs and any outstanding debts you may have.

You’ll also need to calculate your income. This is the money you receive each month from any work you do, as well as income from benefits, pensions and investments or any money from partners or relatives.

Finally, calculate your regular spending. To do this you will need to look at what you spend every month in each of the following categories: Housing costs, household bills and services, court payments, travel costs, housekeeping, leisure and entertainment, health and personal care, debt repayments and other essential living costs.

Use the help available

Are you eligible for a government grant or scheme? It may be worth checking before plunging headfirst into saving for a full deposit. There are several ways in which the government is trying to help first-time buyers: the Help to Buy equity loan scheme and through the shared ownership scheme.

Help to Buy equity loan

Through the loan, the government will lend up to 20% of the cost of a newly built home. This means the cash deposit required will be less, just 5% and the mortgage payments will also be lower.

The current scheme runs until March 2021. After that, there will be a version that will run for two years. It’ll be available for first-time buyers only.

Shared ownership

Shared ownership lets you buy part of a newly-built property and pay rent on the rest. You can increase the proportion you own by buying further shares in the property. If you ‘staircase’ to 100% you become the outright owner of the property. If property prices go up you’ll pay more for increasing your share.

John Baybut MNAEA, MARLA, MRICS

Formby has long been a desirable place to live for people residing in Merseyside. Geographically, Formby is ideally situated between Liverpool and Southport, nestled in the beautiful surroundings of beaches, fields and forests. Buying a property in Formby means you will be neighbours with some of the Premier League’s most notable footballers as well as numerous celebrity and famous faces.

Berkeley Shaw have compiled a guide to some of the town’s key attractions to highlight why Formby is so special.

Who lives in Formby?

Formby is predominantly a residential area catering for families to settle.The town is home to seven primary schools including Freshfield Primary school and two strongly rated secondary schools; Formby High School and Range High School. Formby village has a close-knit community feel with many familiar retail and hospitality brands featured on the high-street.

Commuter town

Formby is a prime location for those looking to live within an easy commuting distance to many of the region’s large cities. Formby is just 25 minutes to Liverpool city centre by train, 30 minutes by car and around an hour’s drive away to Manchester. This means that those wanting to move away from the city to somewhere quieter, but still need to be close enough to access the larger cities quickly, will find the ideal location in Formby.

Formby’s local amenities

Formby has numerous restaurants, bars and shops which includes both national chains including Waitrose, Marks and Spencer Food Hall, Tesco, Cafe Nero, Subway and McDonalds and independent outlets such as Suay, Sorrento and Tibu.

If you enjoy the outdoors, Formby has much to offer. The award-winning beach and coastline has beautiful sand dunes and prehistoric footprints, perfect sights for a long walk. The rare red squirrels are also a major attraction to the area. The National Trust site is one of the few remaining refuges for the red squirrel.

There are numerous other leisure activities to be enjoyed in Formby including the famous links golf course of Formby Golf Club which is set amongst the coastal sand dunes as well as Formby Hall Golf Resort and Spa. Moreover, Formby Pool Trust also operates a successful leisure centre which is home to a gym, swimming pool and cafe.

Premium properties

Formby is home to some of the most exclusive properties in the region. Most notably, Shireburn Road which is Merseyside’s most expensive street and Victoria Road which also ranks in third. Many of which feature luxurious facilities including swimming pools and cinema rooms.

Karen Parks

Head of Residential Sales